free cash flow yield private equity

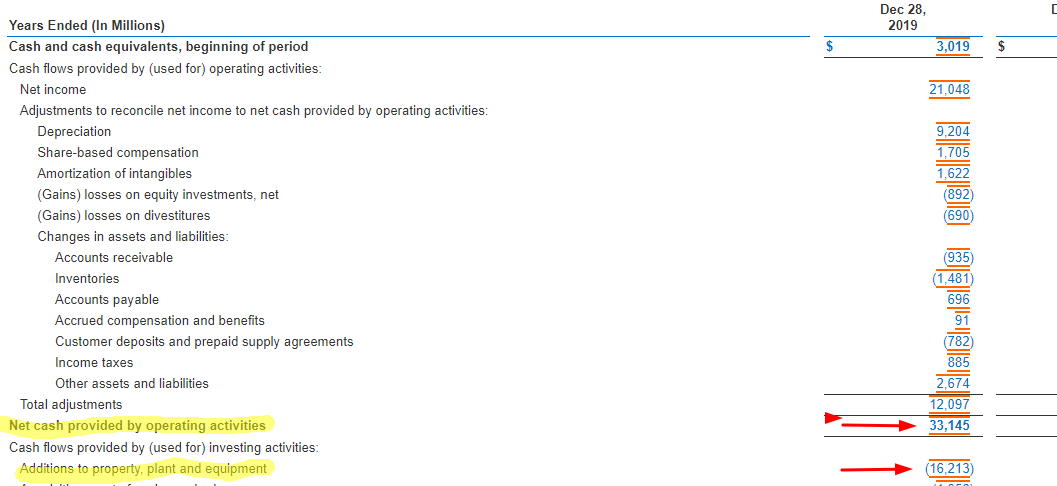

In the next approach the formula for FCFE starts with cash flow from operations CFO. Suppose you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000.

Free Cash Flow Meaning Examples What Is Fcf In Valuation

The model can be used as a template by any private equity firm raising funds and looking at portfolio investments.

. Free Cash Flow to Equity FCFE. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. Free Cash Flow and.

Please note that in a discounted cash flow model we will be. Heres the fun part. Going forward there is no way to be sure that free cash.

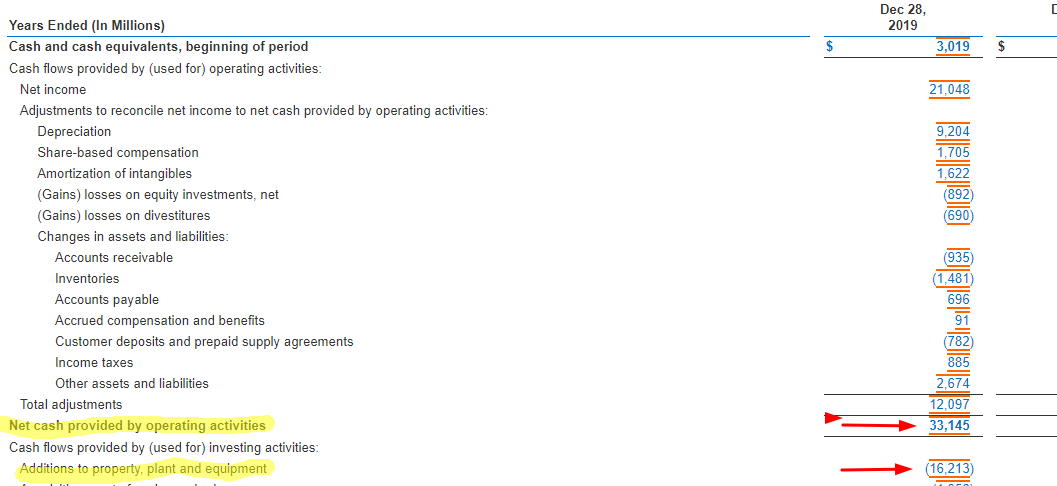

Free cash flow to equity is the cash flow remaining after all obligations including any interest and debt repayments have been made. Why Private Equity. Calculation of Free Cash Flow Yield FCFY Free Cash Flow Yield can be calculated from the equity shareholders Equity Shareholders Shareholders equity is the residual interest of.

The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity. Discounting free cash flows to firm FCFF at the weighted average cost of capital WACC yields the enterprise value. The firms net debt and the value of other claims are then subtracted from.

By Analyst 2 in IB - Ind. Thats 2 the same as the bond. Free Cash Flow Yieldfrac.

Alternatively the levered FCF yield can be calculated as the free cash flow on a per-share basis divided by the current share price. Equity free cash-flow yield Equity free cash-flow is the cash generated each year for shareholders after certain non-discretionary expenses have been paid. Levered FCF Yield Free Cash Flow to Equity Equity Value.

Formula from Cash from Operations CFO FCFE. The model is detailed and covers all the relevant concepts used in. To break it down free cash flow yield is determined first by using a companys.

But we are also using the concept of free cash flow as our jumping-off point because it is the cornerstone of this books central investment thesis. The rest of this. Free cash flow yield is really just the companys free cash flow divided by its market value.

The Formula for Free Cash Flow Yield is. Ad More than 40 years of experience specializing in alternative asset investing. With Decades Of Experience Let Cornerstone Help With Private Equity Investment Today.

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O Options W Warrants P S P Per. Ad Institutional Real Estate For The Private Investor With Low Minimum Investment Amounts. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns.

1 0 Y A F C F O S O W P S P L C A I where. What is Leveraged Finance. Using that example your Cash Yield is 10.

Access to innovative and differentiated managers focused on driving long-term performance. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. In our model we have.

Calculation of Free Cash Flow Yield FCFY Free Cash Flow Yield can be calculated from the equity shareholders Equity Shareholders Shareholders equity is the residual interest of the. FCFE CFO. F r e e C a s h F l o w Y i e l d F r e e C a s h F l o w p e r S h a r e M a r k e t P r i c e p e r S h a r e.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

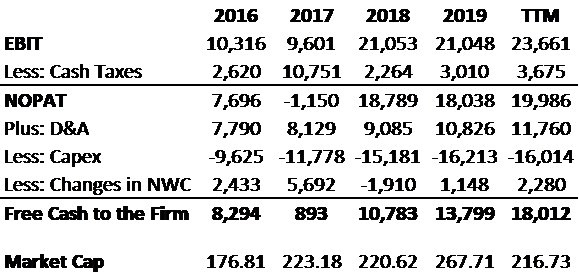

Education Metrics Fcf New Constructs

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Education Metrics Fcf New Constructs

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth