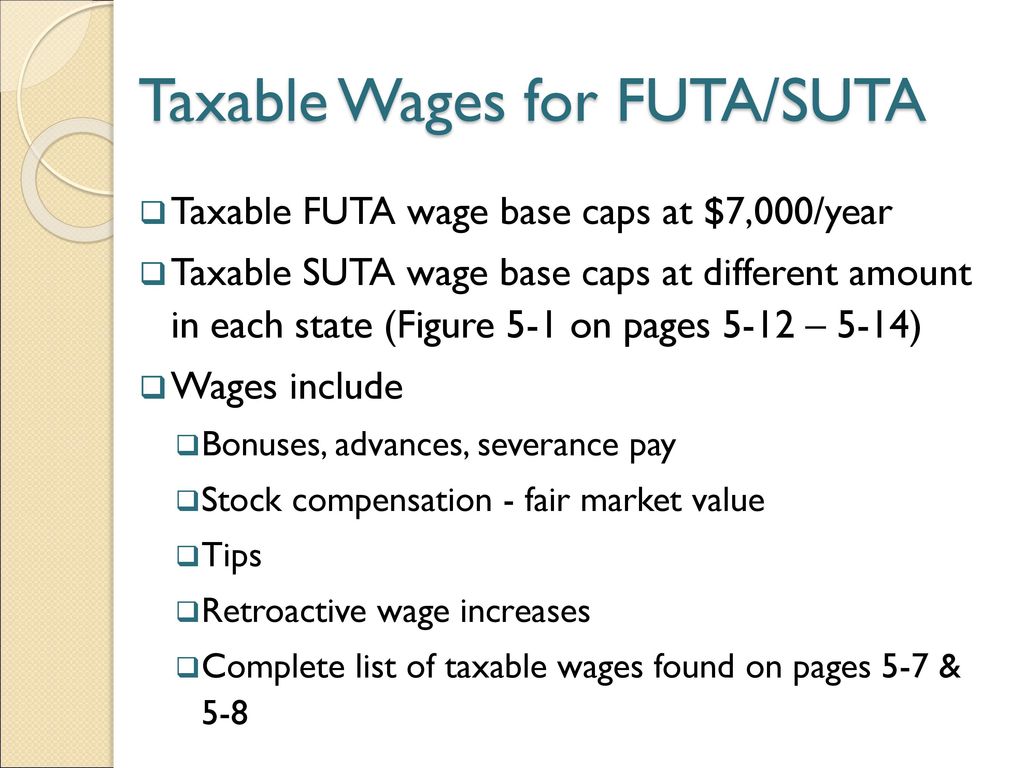

what is suta taxable wages

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. The ranges are wide.

Solved 100 Futa Rate The Available 2015 Rates Were Used Chegg Com

The SUTA wage base is the same for all employers in the state.

. This will depend on the amount of wages that you pay during a calendar quarter. La Igualdad De Oportunidad Es La Ley Equal Opportunity EmployerProgram Auxiliary aids and services are available upon. Utah employers are only liable for state UI taxes on wages paid to each employee up to the taxable.

The taxable wage base is the maximum amount of income that is taxed. The tax rates are updated periodically and might increase. The 2021 SUI taxable wage base increased to 11800 up from 11600 for 2020.

Taxable wage base to increase. Kentuckys range for example is 03 to 9. The rate is calculated each year based on average wages in.

You will be liable for state unemployment taxes if the total amount of wages you pay for domestic services in a. The amount each employee was paid for. Each state also decides on an.

So beyond that threshold the employees wages wouldnt be taxed for SUTA purposes. The taxable wage base may change from year. As of 2020 the SUI taxable wage base remains 7000 for individuals.

Each state has its own SUTA tax rates and taxable wage base limit. The FUTA tax is 6 0060 on the. Employers in California will have to pay their SUI tax rate at 1.

However some states Alaska New Jersey and. As a business owner you can also save on SUTA taxes by optimizing. During 2022 the taxable wage base is 4160000.

In some cases however the employee may also have to pay. The SUI taxable wage base will continue to increase over. Each state decides on its SUTA tax rate range.

The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. What is the Current Taxable Wage Base. The taxable wage base is the maximum amount on which you must pay taxes for each employee.

You pay unemployment taxes on your employees gross wages up to the taxable wage base. The best negative-rate class was assigned a rate of. 52 rows For example if you own a non-construction business in California in.

State Unemployment Tax Act SUTA Equal Opportunity is the Law. What you pay unemployment taxes on. The EDD notifies employers.

The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base. New companies usually face a standard rate. Assume that your company receives a good assessment and your.

New employers pay 34 percent 034 for a period of two to three years. The UI rate schedule and amount of taxable wages are determined annually. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

20 rows State unemployment tax assessment SUTA is based on a percentage. The Current Suta Rate For 2020 Is 0575. The wage base for SUTA on the other hand varies according to the state your business is based in.

A taxable wage base or threshold is the maximum amount of an employees income that can be taxed. In this way what wages are subject to unemployment tax. Employers pay federal unemployment tax based on employee wages or salaries.

52 rows SUTA Tax Rates and Wage Base Limit. Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages.

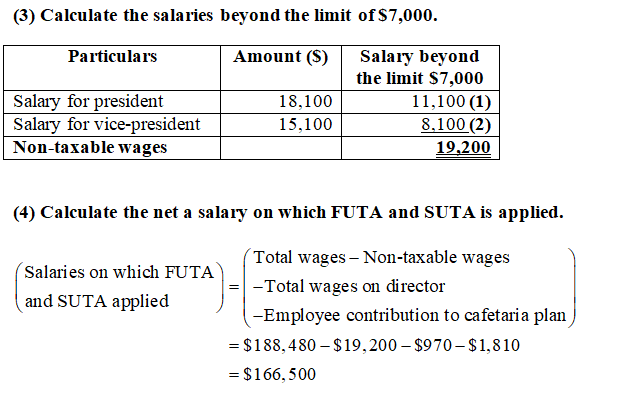

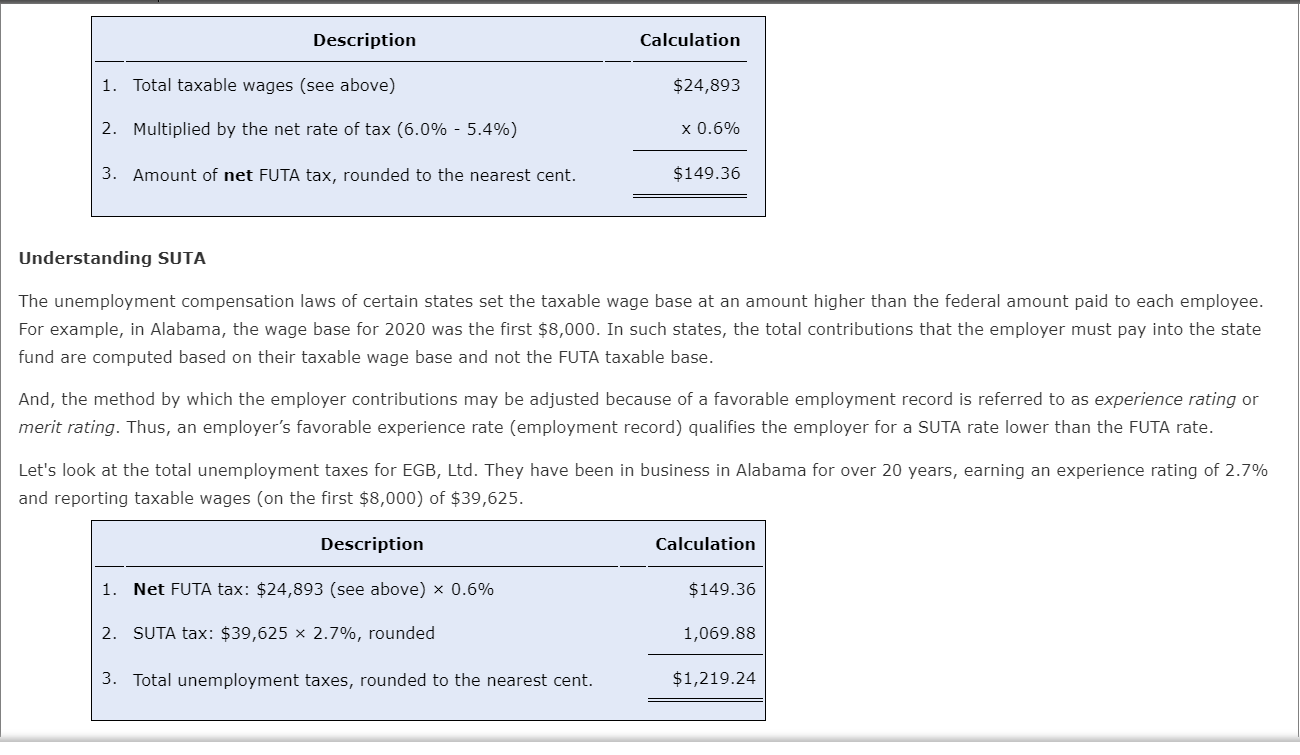

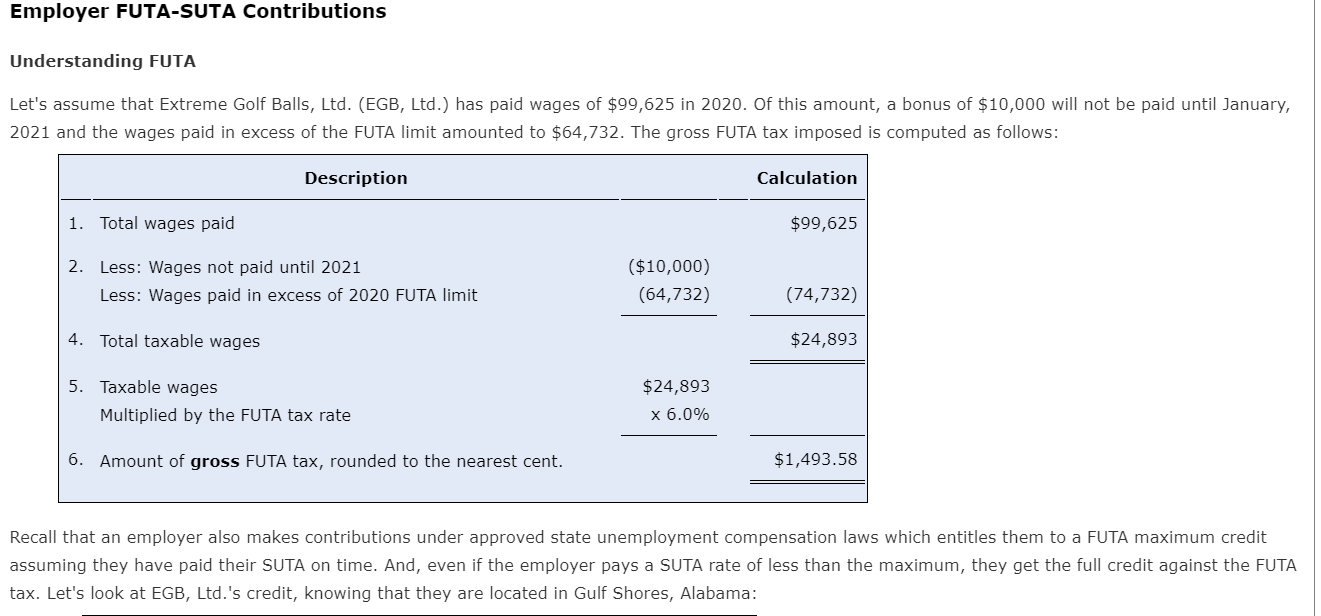

Employer Futa Suta Contributions Understanding Futa Chegg Com

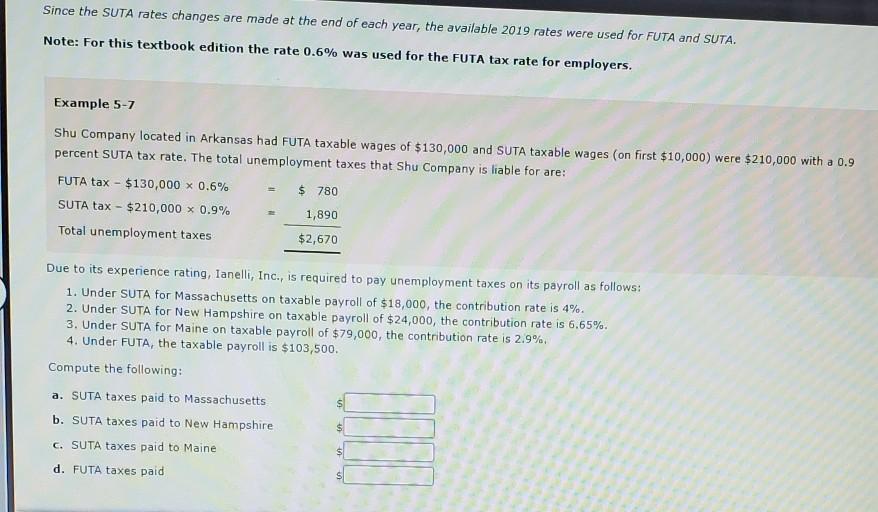

Unemployment Taxes Federal Unemployment Tax Act Futa Ppt Download

Employer Futa Suta Contributions Understanding Futa Chegg Com

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

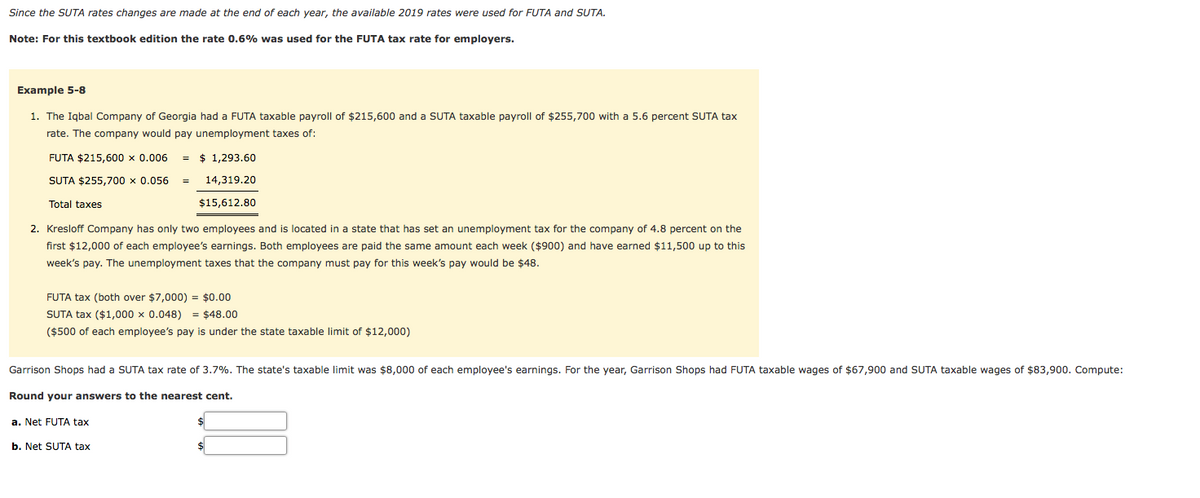

Answered Garrison Shops Had A Suta Tax Rate Of Bartleby

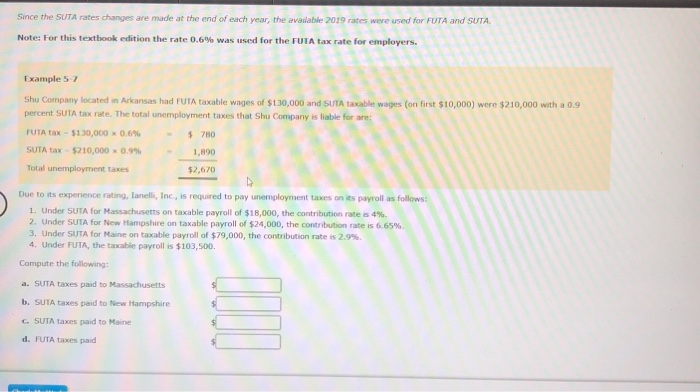

Solved Since The Suta Rates Changes Are Made At The End Of Chegg Com

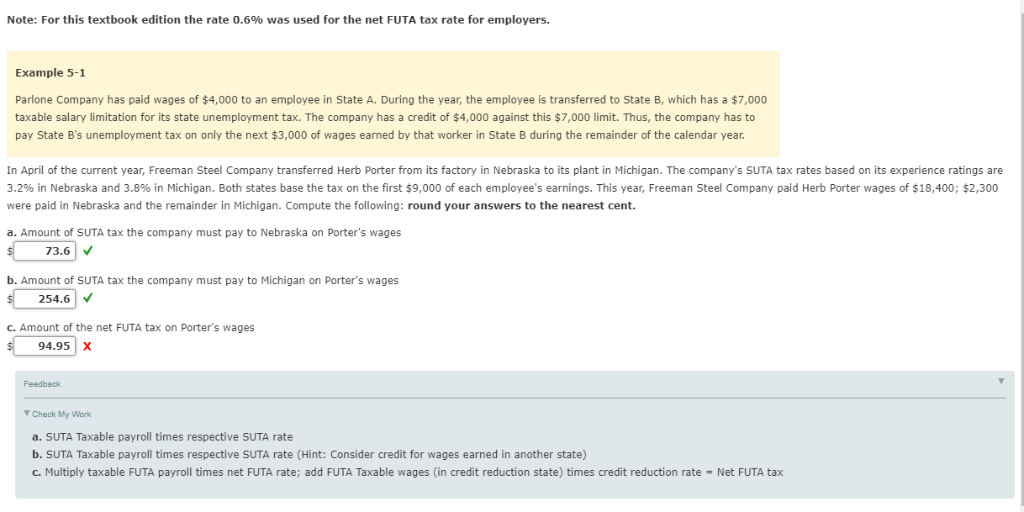

Solved I Need Help With C Please I Cannot Figure Out How Chegg Com

Solved Since The Suta Rates Changes Are Made At The End Of Chegg Com

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

Futa Tax Overview How It Works How To Calculate

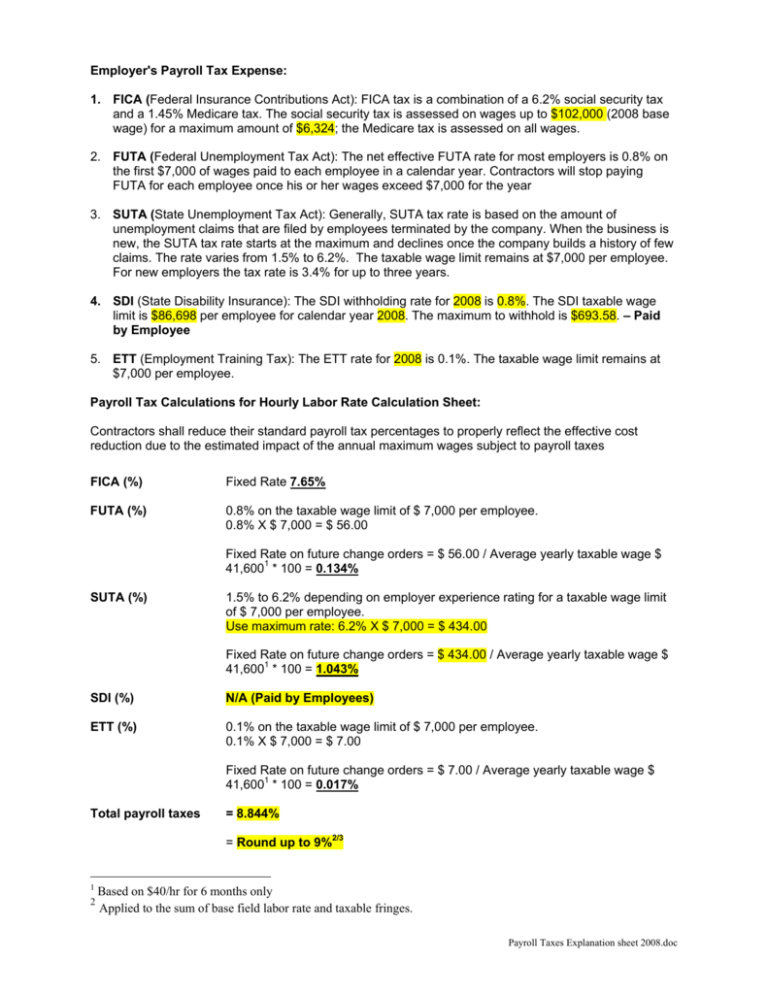

Employer S Payroll Tax Expense

Suta Tax Your Questions Answered Bench Accounting

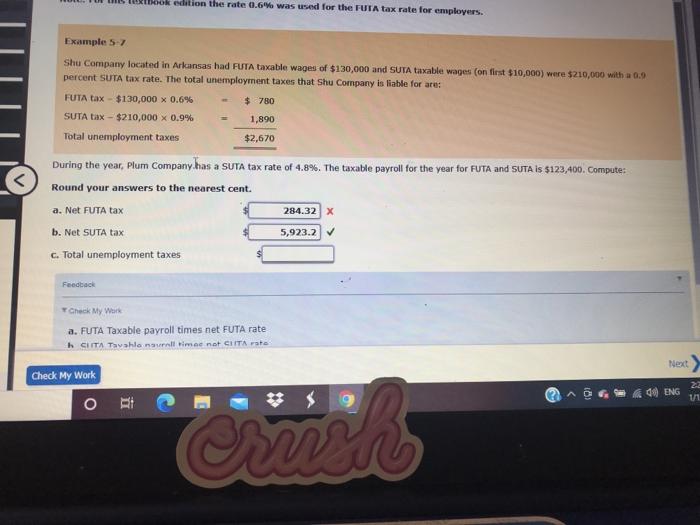

Solved Ook Edition The Rate 0 6 Was Used For The Futa Tax Chegg Com

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Cal Ruther An Employer Is Subject To Fica Taxes But Exempt From Futa And Suta Taxes During The Last Quarter Of The Ye Homeworklib